CalHFA Down Payment Assistance Program

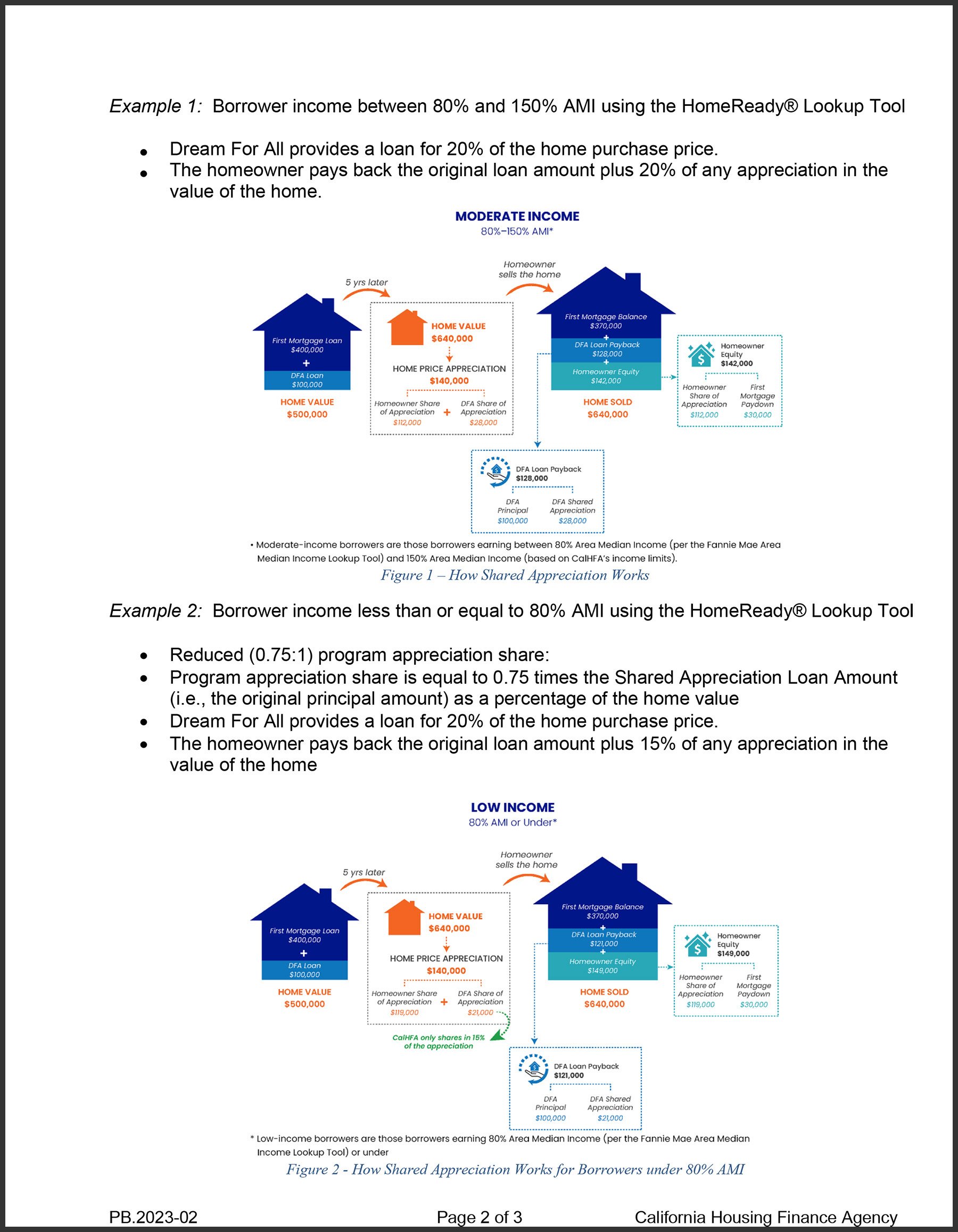

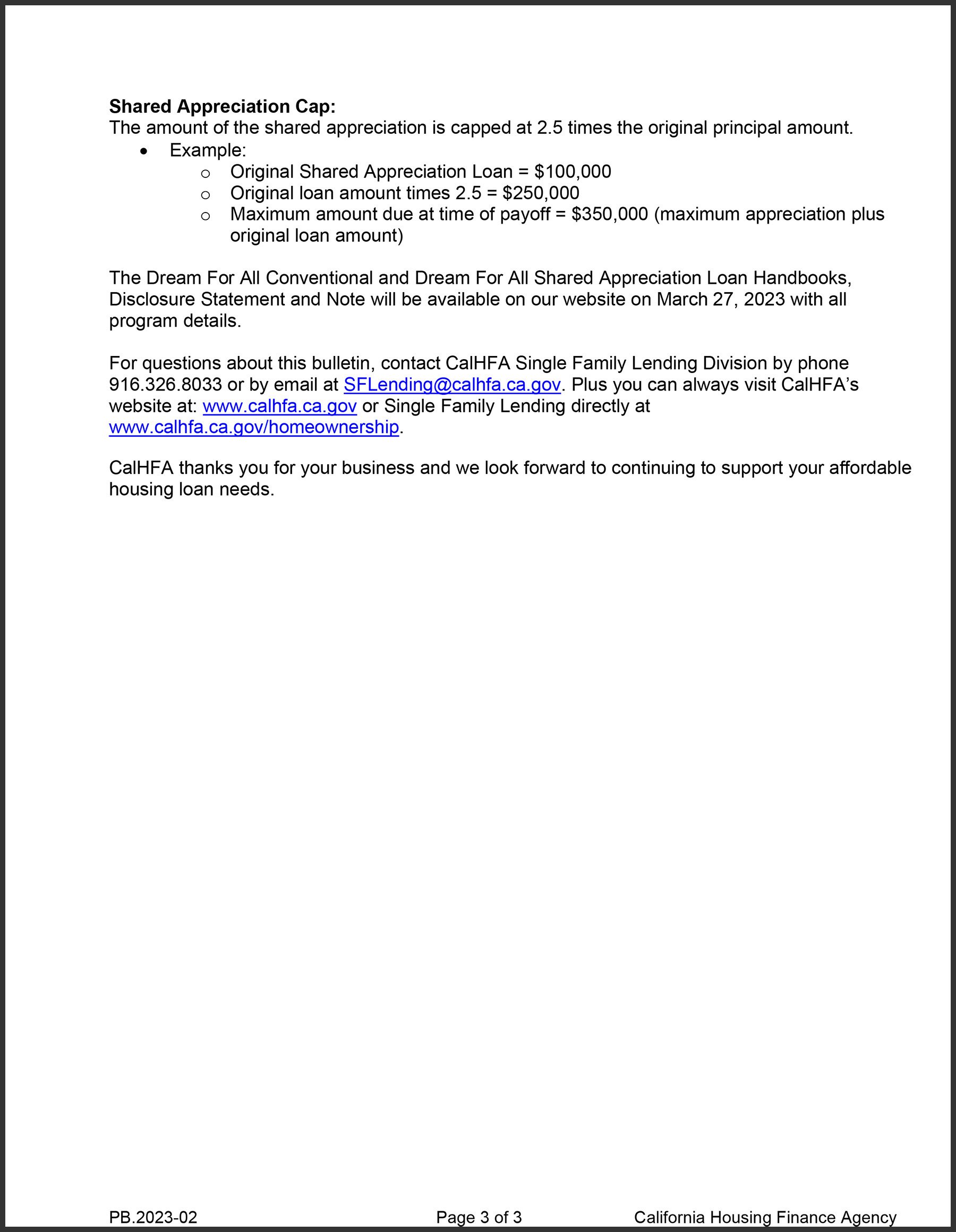

The CalHFA Dream For All Share Appreciation Loan is a form of shared investment where CalHFA invests up to 20% of the cost of your home purchase and also gets up to 20% of the appreciation when you sell the property.

Program Details:

A first time homebuyer is defined as someone who has not owned or occupied their own home in the last three years.

This program applies to single unit detached homes, or approved townhomes and condominiums.

The CalHFA contribution can be used for down payment or closing costs.

The maximum CalHFA contribution is the lower of either 20% of the purchase price or 20% of 105% of the appraised value.

The maximum loan amount in Contra Costa is $1,089,300.00, so with the full 20% down payment assistance the maximum sales price will be $1,361,625.00

Minimum credit score requirement is 640.

Debt to income ratio must not exceed 45% for those with credit scores under 700, and cannot exceed 50% for those with credit scores 700 or higher.

Upgrades to the property do not decrease the CalHFA percentage of equity appreciation, but they may affect the overall value of the property and therefore the amount of appreciation that CalHFA is entitled to.

The mortgage may be refinanced one time. On any subsequent changes to the chain of title, the CalHFA loan must be paid back, including the share of the appreciation that CalHFA is entitled to.

The CalHFA appreciation is capped at 250% of the original value.

If the property is sold at a lower price than the original purchase price, CalHFA is entitled to be paid back their original contribution.

Income limit for Contra Costa and Alameda counties is $282,000. Income limit for Santa Clara, San Mateo and San Francisco counties is $300,00. See full chart.

Homebuyer will be required to attend a Dream For All training class.

* Buyer to confirm program details with mortgage lender.

Program Update - April 7, 2023

The $300 Million Dream For All Shared Appreciation Loan program funds will likely be depleted by April 10, 2023. See CalHFA Program Bulletin.